Habitat Homeownership

Habitat McHenry County strives to make homeownership affordable for more families. We provide a hand up, not a hand-out. Meaning we’re in active partnership with homebuyers in our program to build and purchase an affordable home.

Habitat for Humanity Homeownership Program

Habitat for Humanity is a home ownership program empowering families to build a new life for themselves through the stability and security of owning their own home. Habitat homes are not given away but are sold to families who qualify and are willing to make a down payment, put in sweat equity labor, and can make a monthly mortgage payment. Habitat homes are affordable because Habitat does not make a profit on construction, the families pay an affordable mortgage and the homes are built with volunteers.

check out our Harvard home builds!

Interested in volunteering at our Harvard build sites? Curious what goes into partnering with Habitat to purchase a home? Visit our Volunteer Portal to sign up today!

Applications are closed for our Forest Downs home builds in Harvard. If you are interested in applying to purchase a home rehab in Crystal Lake, please click to add your contact information to that list below.

COMING SOON

to Crystal Lake!

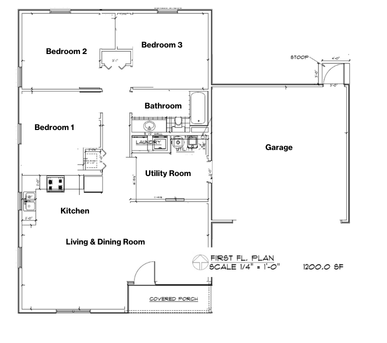

Applications will be opening August 1st, 2024 for a 2-bedroom, 1-bathroom Habitat home rehab in Crystal Lake.

Specifically interested in our upcoming Crystal Lake opportunity? Click here to enter your contact information and be notified when applications open:

Homeownership Program Eligibility

In order to qualify for our program, applicants must be able to, at minimum, afford 50 percent of the appraised value of a Habitat home.* We’ve determined this income sets future homeowners up for success with a solid financial foundation and less vulnerability to financial challenges, including rising cost of living. This can contribute to long-term stability and successful homeownership.

*Habitat homes are appraised by a independent appraiser at fair market value. In 2023, three bedroom, one bath homes appraised at approximately $275,000.

Habitat’s eligibility is based on consideration of the following criteria:

Need for Housing

- Cost-burdened housing; paying more than 30% of gross monthly income on rent.

- Overcrowded: Size is inadequate for the present or anticipated residents.

- Unsafe, unsanitary living conditions or located in a particularly unsafe area.

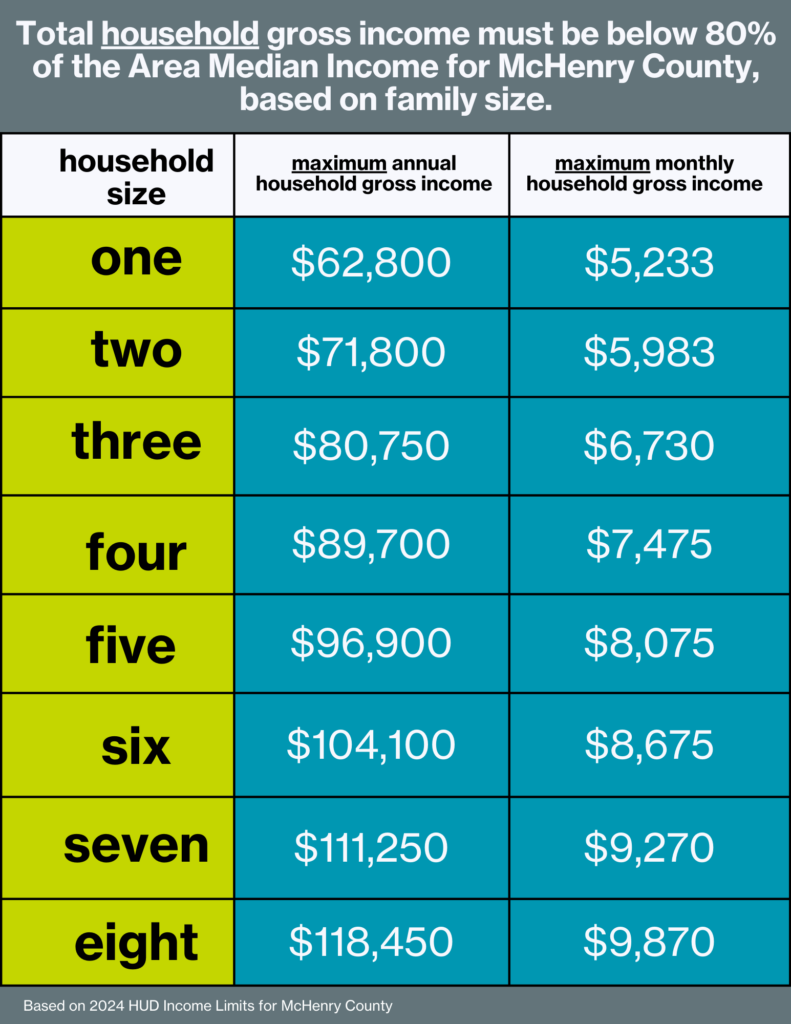

- Gross household income below 80% of the area median income (AMI), based on household size, for McHenry County.

Willingness to Partner with Habitat

- Submit all requested documentation and/or information in a timely manner.

- Complete pre-purchase financial education.

- Schedule and complete a minimum of 250 partner volunteer hours.

- Attend all financial classes and check in meetings.

- Display open and truthful communication with Habitat.

Ability to Pay an Affordable Mortgage

- Stable and consistent source of income.

- Income can come from various sources, including employment, government assistance, pensions or other sources if it is verifiable, reliable and expected to continue for three (3) years.

- At least one year of stable employment.

- Satisfactory credit history with FICO score over 640.

- Qualify for a Habitat mortgage no more than 30% of applicant(s) gross income through a third-party lender.

- Able to save a minimum of $3,000 to cover a percentage of closing costs.

- No outstanding collections, liens or judgments.

- Bankruptcy – minimum of two years since discharge.

- Monthly debt payments no more than 11% of gross monthly income.

- Calculation = Monthly debts/Gross monthly income (pretax.) Debt to consider: credit cards, car loans, student loans, child support, alimony, etc.

- Applicant(s) must be a U.S. Citizen or Permanent Resident.

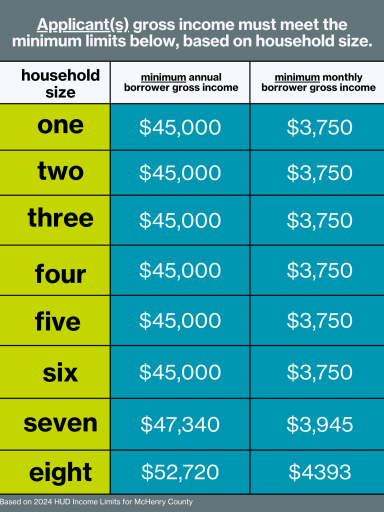

- Applicant(s) gross annual income meets or exceeds the minimum income limits, based on household size, see above.